The 2024 U.S. presidential campaign crossed another milestone this week with the first televised debate between the two major-party candidates. The week before, Vice President Kamala Harris visited rural communities in Georgia to spend time in constituencies largely unfavorable to Democratic candidates. Why spend so much time in counties Harris won’t likely win?

Extending reach.

“Harris traveled to southern Georgia in order to lose by less in those areas, not to win,” Rohan Castelino, CMO of adtech platform IRIS.TV told MarTech.

The Harris campaign was mirroring the strategy used by Sen. Raphael Warnock (D-GA) during his 2022 reelection campaign. Instead of targeting favorable areas to rally likely supporters, the strategy is to connect with individual voters regardless of their location.

In battleground states around the country, campaigns are looking to extend their reach to win close elections. This means looking beyond the usual geographic and demographic data or building off of that data in unconventional ways.

In advertising, for instance, tech partners like IRIS.TV are making it possible for ads to run during programs that fit in deep contextual ways. This helps identify relevant programs and other content beyond obvious categories like news coverage.

Growing reach contextually

Contextual targeting helps brands, too. When ads saturate TV and digital channels during the holiday rush, contextual targeting identifies relevant inventory where competitors might not be looking.

“Traditionally, people would look at endemic categories — if it’s a sports brand, let’s target sports,” Castelino explained. “But what we’re seeing is that when you’re able to understand, at an individual asset level, what the content is about, you can map on the first-party data profiles of your customers.”

A Carl’s Jr. campaign this year used IRIS.TV-enabled contextual data mapped on the restaurant chain’s first-party data. The company targeted its campaign by geography and the obvious food category, but then it went into other less-obvious categories like gaming. The campaign delivered 35% incremental lift on visits to stores and 152% incremental sales lift, according to IRIS.

Deterministic household data that ensures the right person is in front of the ad doesn’t guarantee they will find it interesting. Matching ads to the right viewing moments depends on context. A study by AVCA (Alliance for Video-Level Contextual Advertising) and eye-tracking technology Tobii showed 42% of viewers were more interested in brands and products from contextually aligned ads than from ads that weren’t aligned.

IRIS.TV uses AI tech partners to gain additional understanding of individual episodes and content to categorize and rate them for advertisers. If a brand wants to avoid violent or risqué content, those highly charged moments are tagged and can be avoided. If a political campaign has a message on women’s issues, it can find relevant situations in a TV drama or comedy and run ads against that. Thirty-eight percent of viewers learned more from ads shown in AI-enabled contextual environments than from ads not contextually placed, according to the same AVCA/Tobii study.

Plenty of CTV for holiday campaigns (in non-battleground locations)

Due to Harris’ late entry into the national race, her campaign is spending big to catch up. However, the Harris campaign’s use of digital video won’t affect most holiday advertisers — especially those who planned and aren’t caught in battleground areas.

“After the move to Harris, we are hearing that they are pushing more of their $200 million campaign budget to digital streaming platforms like Hulu, Roku and YouTube to grab the attention of a younger demographic,” said Dan Larkman, CEO and founder at CTV and programmatic company Keynes Digital. “In terms of our business and the performance for our clients, this is not projected to impose any major spikes in price or loss of performance on our client campaigns as we locked in a large volume of CTV PMPs for Q4 already and do not rely on YouTube inventory.”

A large proportion of Keynes Digital’s clients upping spend for the holidays “based on increased channel opportunities and performance,” Larkman said.

The impact of the political season on streaming campaigns is relatively small. Political campaigns, on the whole, are split 75%/25% in linear and broadcast TV over CTV. Key battleground cities represent only 7% of total CTV spend at Keynes Digital, said Larkman.

According to IAB, 89% of ad sellers, including publishers, platforms and adtech partners, increased ad inventory in the politics category, if they had that category available. Eight-six percent experienced an increase in demand for political ads compared to the last presidential cycle. And since Harris entered the race, the vast majority of ad sellers have seen increases in political ad demand at the national (91%) and local (75%) levels.

Dig deeper: Brands have options when breaking through the political noise

Placing Taylor Swift’s endorsement in context

Contextual relevance got a sizable boost in the Harris campaign this week when Taylor Swift announced her endorsement on Instagram. The pop star’s IG has 283 million followers.

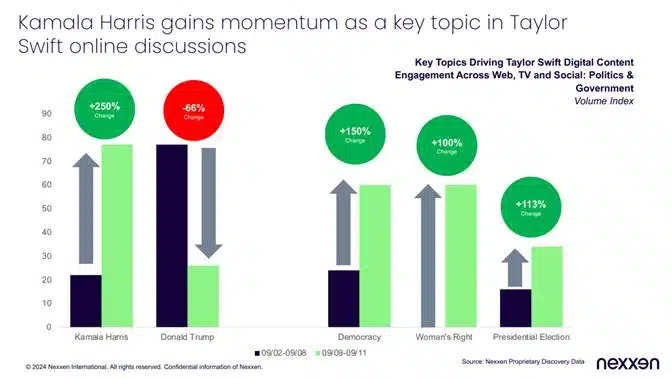

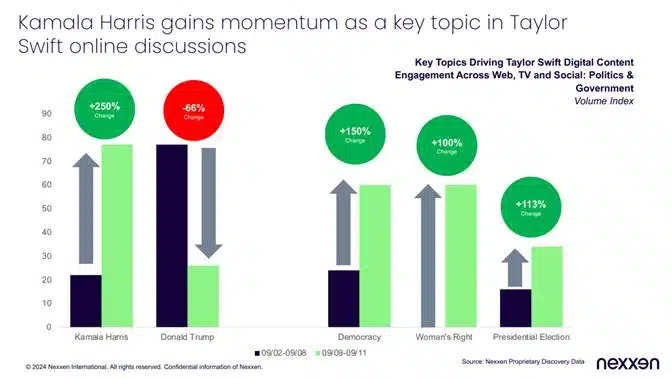

Early evidence shows the endorsement boosted interest across digital channels about issues related to the 2024 race found in Swift’s sphere of influence. Mentions of Harris skyrocketed in Taylor Swift-related discussions in the hours after the endorsement, while discussions about Harris’ opponent, former President Donald Trump, declined.

These mentioned were measured by the digital discovery platform Nexxen across web, TV and social media.

Connecting with customers around their passions can help brands and political campaigns alike find common ground on other issues relevant to both parties.