This year, viewers are watching more CTV in longer sessions. Viewership now approaches pandemic-era levels after pulling back in recent years, according to a new study, “The CTV Trends Report 2024,” released by Wurl, an AppLovin company.

Average daily hours of CTV viewing are up 5% year over year, according to the study, which draws on Wurl’s insights from more than 4,000 channels and 1 billion monthly viewing hours through its CTV marketing platform.

Additionally, average session length is up 7% YoY, indicating that viewers are sticking to a particular program or streaming app for a longer period of time on average.

Pandemic-era rebound. Both average daily hours and average sessions are climbing back toward their pandemic peaks after declining post-pandemic.

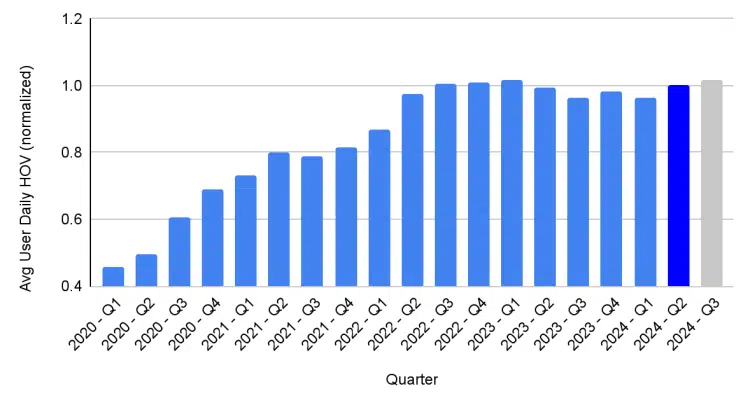

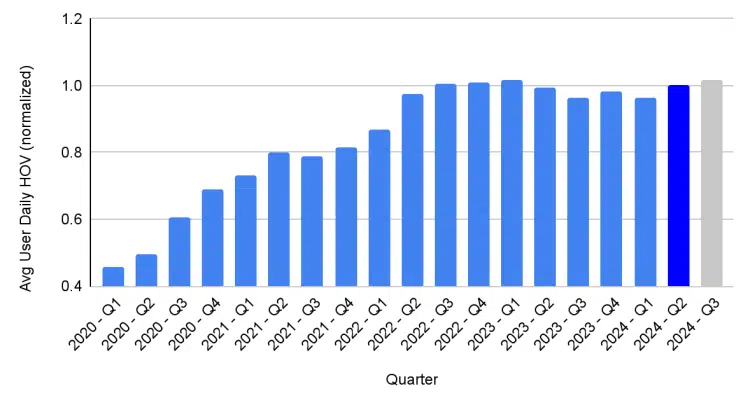

Here’s how average daily hours increased during the pandemic, dipped and rebounded. The chart is “normalized,” using the most recent complete data as the standard against which earlier periods are compared.

The average daily hours of viewing peaked in 1Q 2023. After losses later that year, the average is climbing back, perhaps helped along by big events in 2024 like the Paris Olympics and U.S. elections coverage.

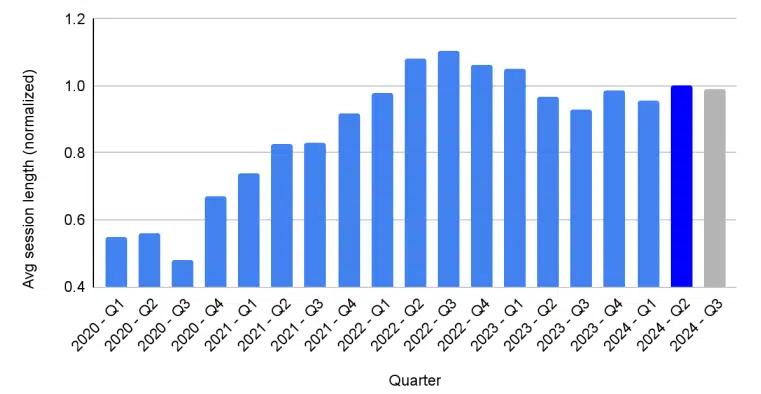

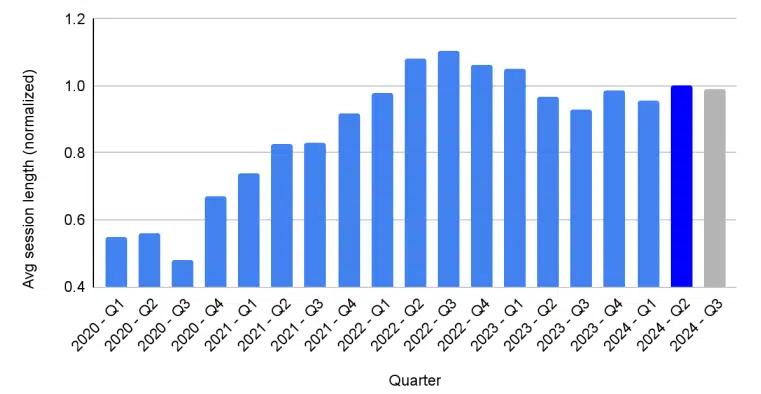

And here is the average session length picture.

This metric peaked in 2Q 2022, earlier than the average daily hours. As new streaming channels and services enter the market, there’s more competition for a viewer’s attention. The recent rise in session length shows that streaming services are finding ways to strengthen viewer loyalty, even in this competitive environment.

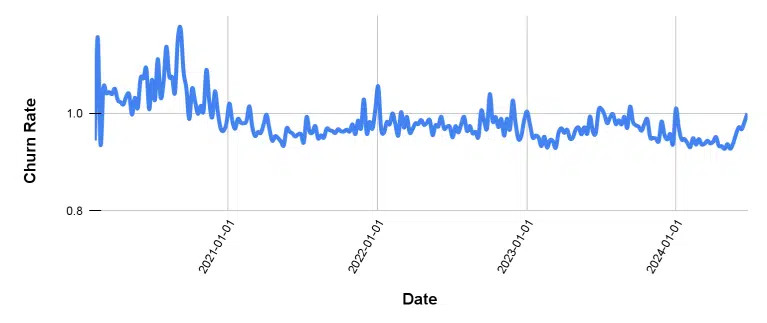

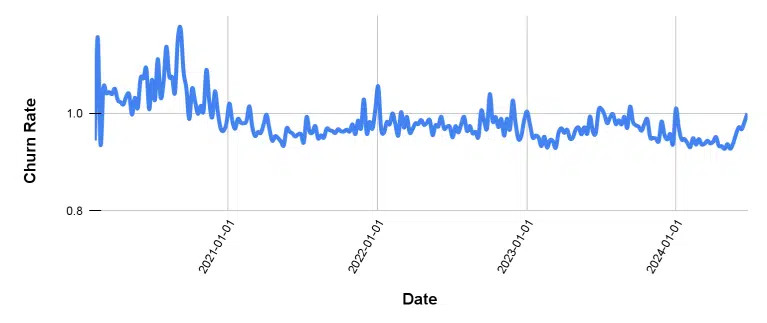

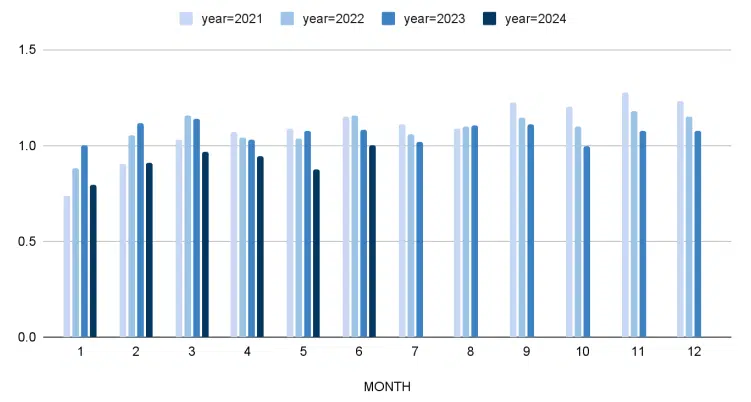

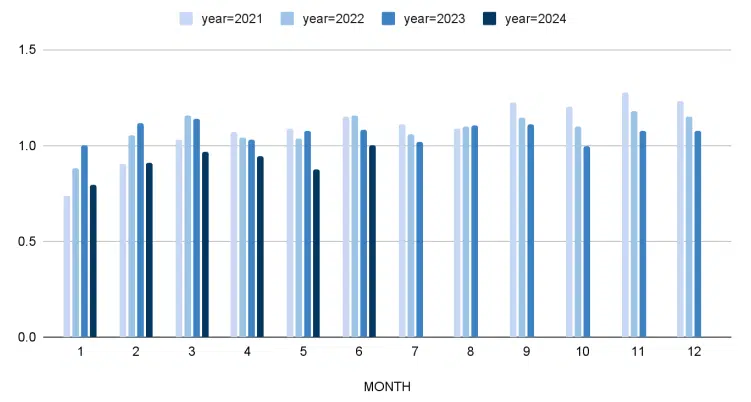

Churn. The churn rate has largely remained stable in the last three years.

While viewing hours increased later in the pandemic years, churn was much higher in the first year, when many people were cooped up at home and experimenting more with CTV services and programming.

Fill rates. Ad fill rates dropped in the first half of 2024 from the previous year. They appear to be rising to 2023 levels as we approach the holidays.

Ad-supported subscription offers from premium streamers like Netflix, along with free ad-supported services (FAST) are increasing the amount of ad inventory while demand is lagging. Fill rates were highest in 2022 when there was less inventory.

Dig deeper: Netflix leans into ad-supported tier as subscriber growth surges

Why we care. The growth in CTV ad revenue assumes that increased viewership makes the investment worthwhile. Viewer behavior matters — these figures show how viewership is formed over time. CTV habits didn’t take shape until multiple years into the pandemic. In 2020, during the most stringent lockdowns, CTV viewing hours were far from their highs. The more recent increase in average session length, along with lower churn, make a strong case for more enduring habits and CTV loyalty taking root for next year and beyond.