Marketers continue to move money into digital video despite significant doubts about audience measurement, according to a new report from the IAB.

Digital video ad spending is expected to be more than $62 billion this year, the IAB predicts. That is a 16% increase over last year and more than twice the $26 billion in 2020.

Since that year ad spend share shifted nearly 20 percentage points from linear TV to digital video. In 2024, digital video will get 52% of the video ad dollars, surpassing linear TV for the first time. This is a reflection of viewers’ shift toward digital. For example, the largest pay TV providers lost 6% of their subscribers in the last two years: 5 million in 2023 and 4.6 million in 2022.

Free ad-supported streaming TV ad spend increased to 51% from 44% last year. It is now in line with ads bought on virtual multichannel video programming distributors (55%) and streaming platforms (53%).

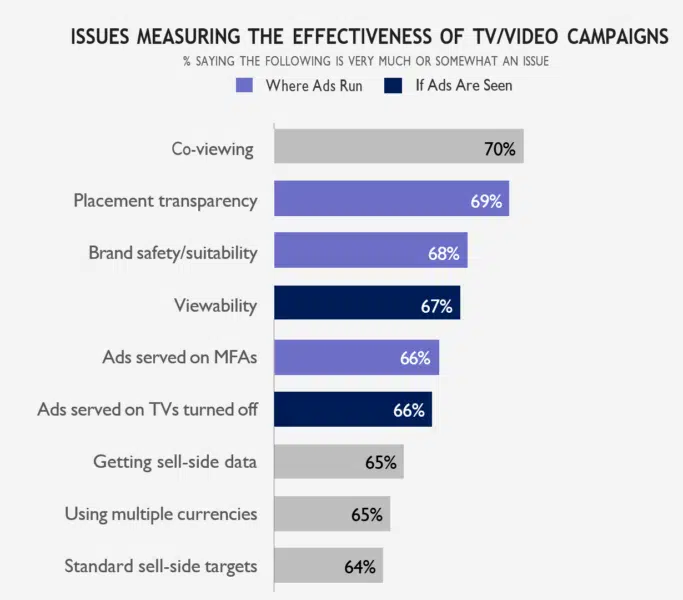

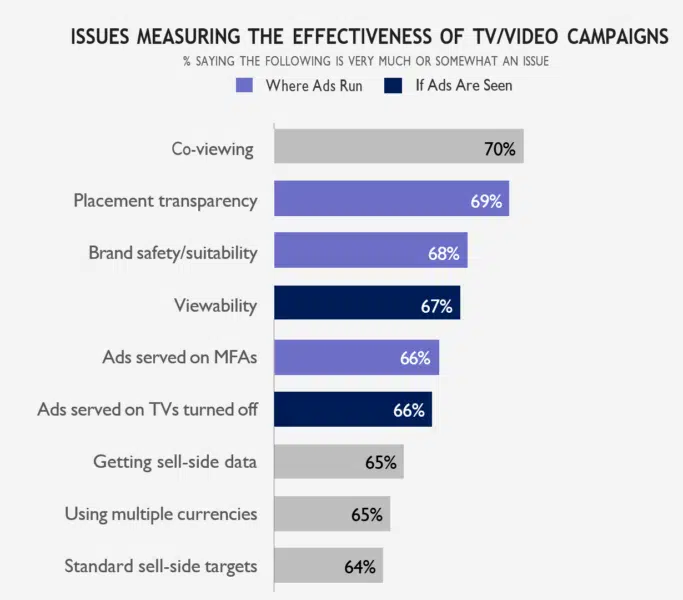

Measurement problems persist

Measurement issues remain an overall problem but vary significantly by channel — particularly with online video and CTV. Inconsistent publisher-level measurement frameworks plague online video. This makes it hard for buyers to understand placement, viewability and guarantees. CTV faces similar issues due to a lack of shared show-level data and inconsistent measurement approaches.

This and the proliferation of privacy-by-design have buyers turning to measurement tools less reliant on data signals. AI, data-driven optimization, MTA and MMM enable buyers to understand performance based on modeled data as signal deprecation decreases the pool of available data.

Dig deeper: How to measure the impact of brand marketing

Nine out of ten advertisers are using some form of alternative audience measurement — either via transacting, testing, or having discussions with vendors. More than 75% of buyers requested that sellers provide greater transparency, offer performance-based solutions, grant access to first-party data and/or help set new measurement standards.

Why we care. Digital video will continue to be a go-to channel for advertisers looking to reach engaged audiences at scale for the foreseeable future. Its popularity is driven by the number of different ways consumers can get content variety formats. That’s why there is so much growth across short-form, long-form, creator-drive and immersive content formats. While this means more work for marketers, it also lets them serve multiple consumer demos, mindsets and interests.

Methodology

The data is from a 15-minute anonymous online survey, taken by 364 people. All respondents:

- Are involved in recommending, specifying, or approving advertising spending in digital video

- Spent at least $1 million on advertising in 2023

- Work at agencies or directly for a brand marketer

The survey was conducted between February 15 and March 1 of this year. The full report can be downloaded here.